Construction Tax Advisor & CPA

Strategic Tax Planning Year-Round

General & Sub Contractors

Independent Construction Pros

Equipment Rental Owners

Construction Equipment Suppliers

Heavy Machinery Services

Home Service Professionals

Tax Advisory CPA for the Construction Industry

We provide specialized tax advisory services for construction professionals seeking to leverage our deep understanding of federal and state-specific tax regulations that impact business outcomes.

Strategic Tax Advisor for Construction Company Owners

With our hands-on experience in accounting & tax advisory for high-income construction professionals, we recognize the real world tax & accounting challenges that add complexity to operating a construction business.

Our tax planning approaches are designed to help you navigate these complexities with a focus on tax savings & streamlined accounting solutions.

Kami Molin, CPA & Tax Advisor

Advanced Tax Strategies ForBusiness owners & High Income Earners

We Understand Construction Taxes & Accounting

Whether your company specializes in residential construction or manage large-scale commercial projects, our tax planning & accounting solutions are powerful tools designed to improve the financial health of your business.

Tax advisory services can be setup to support a wide range of successful construction professionals, assisting in accounting practices, tax strategy and more.

Your Construction CPA

Providing Year-Round Tax Planning

How Tax Advisory Helps Construction Pros

Our services can help business owners to:

- Optimize cash flow timing

- Minimize tax liabilities

- Ensure compliance with IRS regulations

- Develop strategic accounting methods tailored to your specific project calendar

In the real world, large scale construction projects often span multiple fiscal years, creating opportunities for revenue recognition strategies.

A skilled tax advisor can assist a construction buinsss owner in optimizing cash flow timing, minimizing potential tax liabilities, and transforming tax laws into opportunities.

Finding Tax Efficiencies in Capital Investment

Construction businesses can require siginificant capital investments in operating equipment, machinery and vehicles.

Our tax & accounting services focus on maximizing your financial efficiency through tax strategies such as:

- Accelerated depreciation strategies

- Section 179 deduction optimization

- Equipment financing tax considerations

- Strategic capital expenditure planning

Ready To Get Started? Contact Us

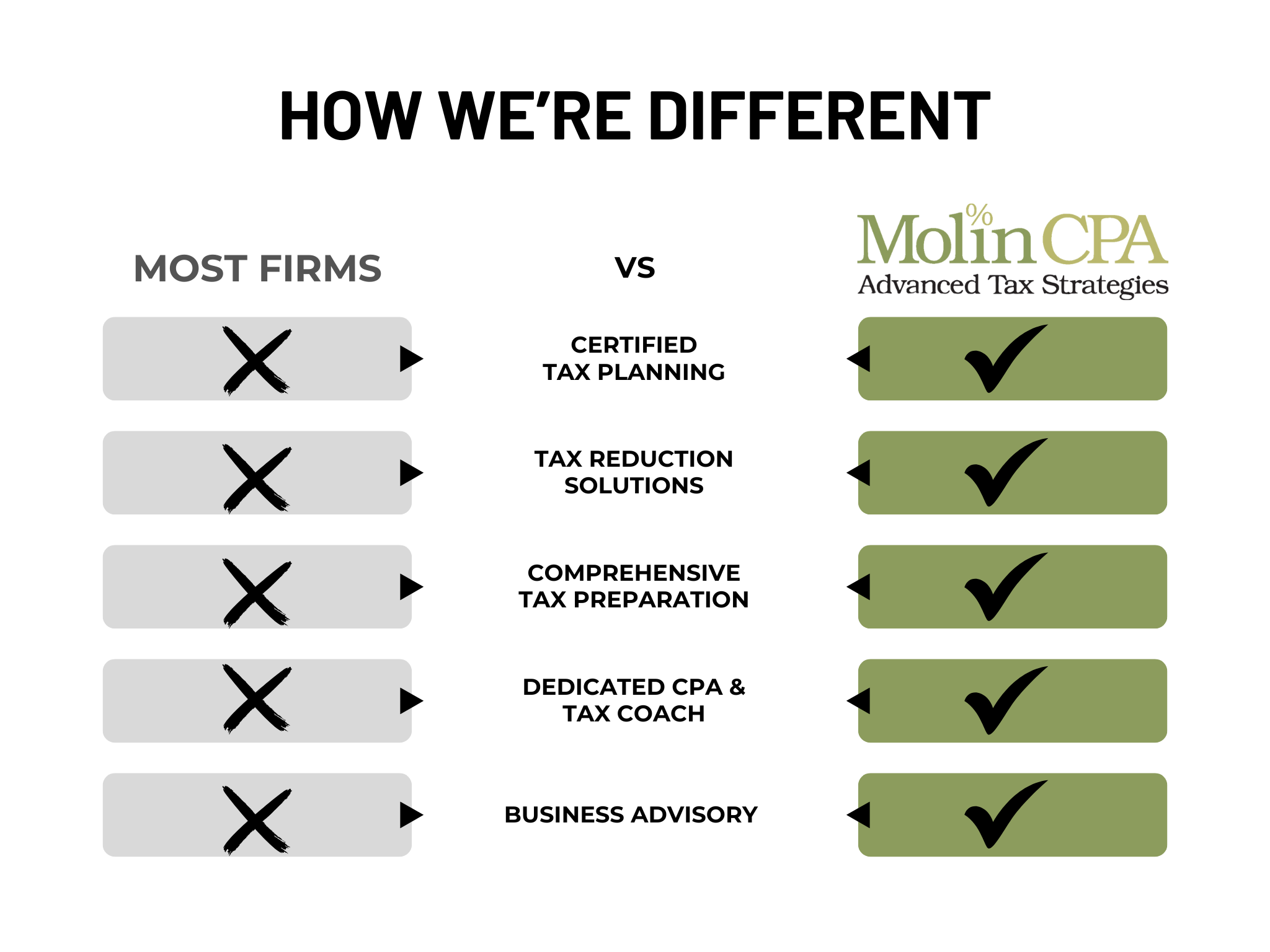

Our approach is different. We focus year-round on tax & accounting strategies that work for construction business owners. With experienced tax advice, proactive planning and strategic implementation, our firm is able to deliver effective results beyond a traditional CPA firm.

Contact us today to schedule a consultation and discover how our specialized tax advisory services can help you achieve your business goals while minimizing your tax burden.

Tax Strategist for

Construction

Helping Business Owners

Save Thousands In Unnecessary Taxes