7 Signs You've Outgrown Your Bookkeeper: A Tax Advisor & CPA's Perspective

A CPA & Tax Advisor Can Offer Integrated Tax & Accounting Functions as a Partial CFO

Transition from Basic Bookkeeping to Strategic Financial Accounting

For small business owners with increasing sales revenues surpassing $250,000 in annual net profit, the transition from basic bookkeeping to strategic financial accounting becomes increasingly critical.

As your business operations expand, financial accounting and tax planning opportunities beyond standard compliance becomes increasingly important.

What once worked well for your operation at an earlier stage with a bookkeeper managed by you as the business owner may now be limiting your company’s financial efficiency and tax optimization strategies.

As a CPA & Tax Advisory firm, we regularly guide growing businesses through this transition. In this article, we will review 7 potential indicators that your business has outgrown its current bookkeeping solution and may benefit from the integrated expertise of a CPA and tax advisor, or even a part-time CFO.

If you’re concerned about paying more than you legally could be in taxes as a high-income earner, contact our office to get started with a consultation.

Our Capabilities

- Federal & State Tax Credits

- Income & Expense Shifting

- Business Entity Structures

- Tax Code Loopholes

- Tax Investment Strategies

- Financial Accounting Strategies

- New Tax Opportunities

How We Work

Our strategic tax planning service is tailored to proactively manage your tax position year-round. Comprehensive tax planning can help you reach your financial goals faster. We are experts with specialized training in tax-optimized strategies and tax advisory.

#1 – Tax Filing Season is Reactive & Stressful for You

Warning Signal: You’re surprised by your tax liability at tax filing time, with little opportunity to implement tax-saving strategies.

When businesses cross the $250,000 net profit threshold, tax planning becomes significantly more complex and consequential. Disconnects between your accounting operations & tax preparation can result in significant inefficiencies, costing you time & money as a business owner.

A bookkeeper typically focuses on recording transactions accurately but lacks the specialized training to identify tax planning opportunities throughout the fiscal year. Professional service firms, technology companies, and manufacturing businesses particularly suffer from this disconnect.

By the time tax season arrives, many opportunities for strategic deductions, entity structure optimization, and timing of income recognition have already passed.

A CPA with tax advisory expertise provides year-round tax planning that can save substantially more than their fee difference compared to a bookkeeper.

#2 – Your Financial Reporting Lacks Tax Implications

Warning Signal: Your financial reports provide net income tracking but don’t offer meaningful insights for strategic tax planning.

As business operations grow over time, business owner can requires more than traditional financial accounting to make informed decisions. While bookkeepers work hard at maintaining accurate records, they typically aren’t experienced with financial analysis that promotes strategic growth, especially when tax implications are involved. Construction companies, multi-location retailers, and businesses with complex inventory management can particularly benefit from enhanced financial reporting beyond a traditional bookkeeper.

A CPA or part-time CFO can implement cash flow forecasting & after tax calculations beyond the standard reconciliation process. The integration between tax advisory & accounting provides tax reduction opportunities and business efficiencies that basic bookkeeping reports simply can’t identify.

#3 – You’re Missing Industry-Specific Financial Optimization

Warning Signal: Your traditional bookkeeper’s financial accounting may miss key tax opportunities specific to your industry.

In the business world, every industry has distinct accounting requirements and financial optimization opportunities related to tax reduction. Medical professional operating medical clinics & dental practices face unique insurance billing cycles, for example. In the construction & real estate development industries, various business types require different forms of operations focused accounting procedures. In the internet & e-commerce world, businesses often require tax & accounting resources that may exceed typical bookkeeping capabilities.

A CPA with industry-specific experience brings valuable insights with strategic accounting & tax advisory focused on improving both operational efficiency and tax outcomes.

#4 – Your Business Structure Hasn’t Been Reviewed as You’ve Grown

Warning Signal: Your business entity structure was established when you started but hasn’t been re-evaluated since.

The tax savings from proper entity structuring can easily reach tens of thousands of dollars annually for profitable businesses—far exceeding the additional cost of CPA services.

Many businesses begin as sole proprietorships or single-member LLCs for simplicity. However, depending on your situation – once profitability exceeds about $50,000 to $70,000 annually, alternative structures like S-Corporations, partnerships, or even multiple entities may offer significant tax advantages.

Real estate investors, professional services firms, and successful businesses with substantial equipment assets often benefit most from business entity re-evaluations & accelerated depreciation strategies. While a bookkeeper maintains records within your existing structure, a CPA with tax advisory experience will proactively evaluate whether your current structure remains optimal as your business operations change.

#5 – Your Current Bookkeeper is Overwhelmed During Complex Transactions

Warning Signal: When accounting for real estate activity, business financing, acquisitions, asset depreciation & year to year accounting procedures go beyond your bookkeeper’s experience.

Depending on the type of your business operations, you may frequently encounter events that affect your financial statements in more complex ways. Some examples can include business succession planning, loan activity, equipment depreciation, business acquisitions, multi-state operations, real estate rental activity or real estate investments. These transactions can require more experience integrating strategic accounting and tax analysis beyond standard bookkeeping capabilities.

The value proposition of a CPA & tax advisor operating as your partial CFO can have significant financial impact by properly structuring major accounting transactions on your behalf.

#6 – Compliance & Licensing in Your Industry Requires Accurate Financials

Warning Signal: Your industry may require compliance with tax regulations, financial reporting requirements, or other accounting obligations over time.

Savvy business operators can expand into new ventures through acquisitions or syndications that may require new financial reporting & compliance requirements. Common strategies that tax advisors consult on such as sales tax issues, employee vs. contractor classifications, and industry-specific regulatory reporting are areas where mistakes can lead to costly penalties.

A traditional bookkeeper may lack the ability to provide accounting & reporting expertise for these more complicated scenarios, especially when tax implications are taken into consideration.

In the compliance world, we know that audit prevention is far less expensive than audit response when it comes to compliance issues.

#7 – The Costs of Your Tax Prep, Bookkeeping & Admin Exceed Our Advisory Fees

Warning Signal: Your in-house bookkeeping costs (salary, benefits, software, training, management time) have grown significantly as your business has expanded.

As businesses grow, bookkeeping requirements expand—often leading to additional staff, more complex systems, and increased management oversight. Many owners are surprised to discover that their all considered bookkeeping costs now exceed what they would pay for outsourced accounting services with a CPA firm, or even a partial CFO working directly with the business owner.

In our experience, a CPA firm or part-time CFO arrangement provides better value than expanding in-house bookkeeping capabilities, especially when the integration of tax preparation, tax planning, strategic implementation are considered.

For businesses generating over $250,000 in net profit, the marginal cost difference between a professional firm vs in-house bookkeeper is likely outweighed by the after plan tax savings and increased certainty for the business owner when working with a CPA & Tax Advisor.

Why We Believe Tax Advisory is Critical

Our experience as Certified Public Accountants (CPAs) and Tax Advisors puts you in the position to benefit from tax planning & strategic implementation, while integrating your tax preparation needs into the on-going advisory process.

At our firm, we view tax preparation as a ‘checkpoint’ in the tax advisory process.

As your tax advisor, instead of only meeting once a year to file your income tax returns, we work together throughout the year so that at tax time, there are no surprises, and you pay as little income taxes as absolutely necessary.

Working With Our Firm

After helping thousands of Californian taxpayers over the years, we have developed a powerful understanding of advanced tax strategies, making us particularly valuable for high-income earners.

If you have been working with another Accountant, Enrolled Agent, Tax Preparer or Bookkeeper that doesn’t proactively bring savings to you, consider working with a dedicated Tax Advisor & Licensed CPA. We’re able to create a custom tax plan and implement a comprehensive tax-saving strategy aligned with your overall financial goals.

7 Signs You’ve Outgrown Your Bookkeeper: A Tax Advisor & CPA’s Perspective

7 Signs You’ve Outgrown Your Bookkeeper: A Tax Advisor & CPA’s Perspective A CPA & Tax Advisor Can Offer Integrated Tax & Accounting Functions as a Partial CFO April...

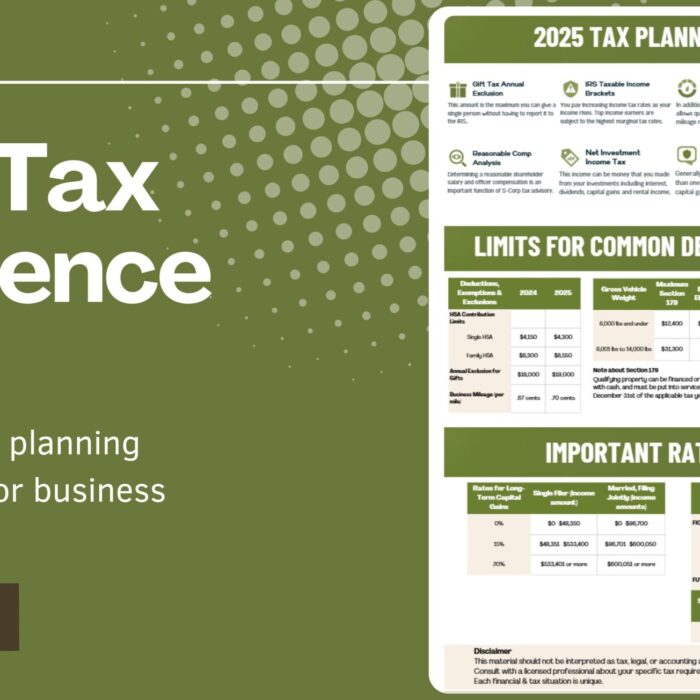

Essential 2025 Tax Reference Guide for Business Owners

Essential Tax Reference Guide for 2025 Our 2025 Tax Planning Reference Guide for High-Income Earners and Business Owners March 23, 2025 Kami Molin Check Out Our 2025 Tax Planning...

Tax Advisor vs Tax Preparer… What’s The Difference?

Tax Advisor vs Tax Preparer… What’s The Difference? Tax Advisory Can Unlock Savings for High Income Earners February 25, 2025 Kami Molin The Key Differences Between Tax Preparation and...

Tax Strategies for California High Income Earners in 2025

Tax Strategies for Californian High-Income Earners in 2025 This Year’s Tax Outlook High-Income Earners in California January 21, 2025 Kami Molin Why You Need a Tax Advisor in California...

Tax Strategy CPA

Business Advisor

Helping Business Owners

Save Thousands In Unnecessary Taxes