Tax Strategies for Californian High-Income Earners in 2025

This Year's Tax Outlook High-Income Earners in California

Why You Need a Tax Advisor in California

Living in one of the largest economies in the world can have its share of relative high tax & living costs. High-income earners in the state of California have unique opportunities in tax strategy, as they face some of the highest state tax rates in the nation.

As a business owner in California, taxes can quickly balloon to be your single greatest expense. High-income business owners in the state of California should strongly consider tax planning & advisory.

If you’re earning more than $250k annually, our tax advisory service can provide tailored strategic tax plan implementation focused on preserving wealth and maximizing tax savings.

With proactive tax advisory, the complex tax code can be transformed into strategic opportunities to lower your taxable income. Through tax advisory & strategic accounting, we help our clients navigate challenging regulatory and tax environments.

If you’re concerned about paying more than you legally could be in taxes as a California high-income earner, contact our office to get started with a consultation.

Our Capabilities

- Federal & State Tax Credits

- Income & Expense Shifting

- Business Entity Structures

- Tax Code Loopholes

- Tax Investment Strategies

- Financial Accounting Strategies

- New Tax Opportunities

How We Work

Our strategic tax planning service is tailored to proactively manage your tax position year-round. Comprehensive tax planning can help you reach your financial goals faster. We are experts with specialized training in tax-optimized strategies and tax advisory.

Tax-Saving Opportunities for California High Income Earners

How Can Tax Advisory Help?

1. Maximizing Retirement Account Contributions

One of the most effective long term tax-saving strategies continues to be maximizing contributions to retirement accounts.

2. Tax Focused Investment Strategies

Tax efficient investment advisory can substantially impact your tax liability. We can review your investment accounts for tax optimization opportunities.

3. Real Estate Investment Planning

Real estate tax laws offer California investors unique tax advantages when operating, exchanging, selling, upgrading & renovating investment properties.

4. Multi-Year Tax Plan Implementation

Proactive Tax Advisory is a year-round activity, not just compliance check. Tax planning for high-income California residents requires a long term approach.

5. Significant Life Changes

We understand how to leverage California’s unique tax code to reduce the tax implications of major life changes that could impact your financial situation.

Keeping More of What You Earn

Our tax advisory service has the ability to help you keep more of your hard earned income through tax planning & strategic implementation.

Working together, we diligently create personalized tax plans to significantly reduce tax liabilities and protect wealth for high income professionals.

California residents earning high incomes face a combined tax burden that can exceed 50% when accounting for federal, state, and local taxes.

The state’s top marginal tax rate of over 13% remains the highest in the nation, affecting top earning single filers earning over $1 million and joint filers earning over $1,250,000.

If you’re a high income earner in subject to the tax environment in California, our tax advisory services can provide many opportunities for keeping more of your hard earned wealth, playing an important role in your financial goals over time.

Assembly Bill 150 for SALT Deductions

In order to support business owners with pass-through entities such as Partnerships, S-Corps, LLCs taxed as Partnerships, LLCs taxed as S-Corps, California passed Assembly Bill 150 in July 2021, allowing a “loophole” or workaround for qualifying California taxpayers to claim a credit on their California tax returns for taxes paid by the pass-through entity.

With California’s Assembly Bill 150, qualifying business entities can elect to pay a 9.3% tax on state income, allowing an entity owner to claim a credit on their state tax return for the qualifying business entity’s taxes paid on their behalf.

Working With Our Firm

After helping thousands of Californian taxpayers over the years, we have developed a powerful understanding of advanced tax strategies, making us particularly valuable for high-income earners.

If you have been working with another Accountant, Enrolled Agent, Tax Preparer or Bookkeeper that doesn’t proactively bring savings to you, consider working with a dedicated Tax Advisor & Licensed CPA. We’re able to create a custom tax plan and implement a comprehensive tax-saving strategy aligned with your overall financial goals.

7 Signs You’ve Outgrown Your Bookkeeper: A Tax Advisor & CPA’s Perspective

7 Signs You’ve Outgrown Your Bookkeeper: A Tax Advisor & CPA’s Perspective A CPA & Tax Advisor Can Offer Integrated Tax & Accounting Functions as a Partial CFO April...

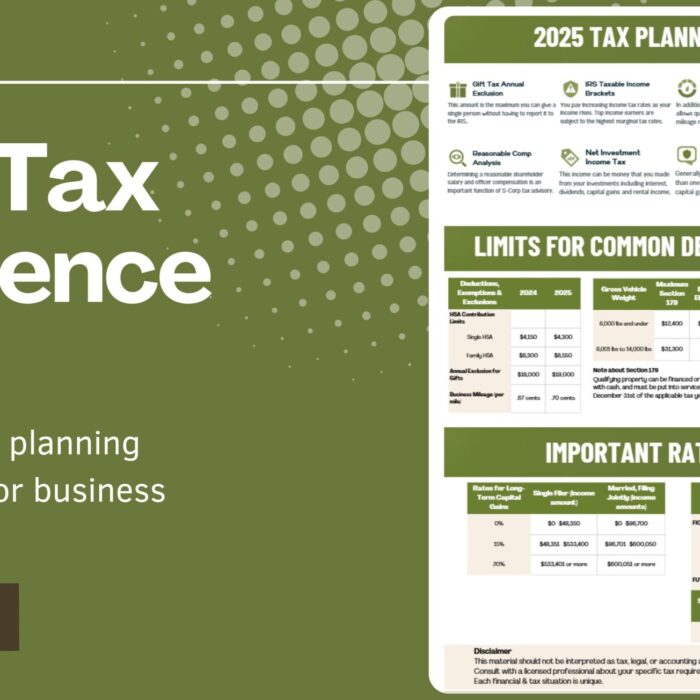

Essential 2025 Tax Reference Guide for Business Owners

Essential Tax Reference Guide for 2025 Our 2025 Tax Planning Reference Guide for High-Income Earners and Business Owners March 23, 2025 Kami Molin Check Out Our 2025 Tax Planning...

Tax Advisor vs Tax Preparer… What’s The Difference?

Tax Advisor vs Tax Preparer… What’s The Difference? Tax Advisory Can Unlock Savings for High Income Earners February 25, 2025 Kami Molin The Key Differences Between Tax Preparation and...

Tax Strategies for California High Income Earners in 2025

Tax Strategies for Californian High-Income Earners in 2025 This Year’s Tax Outlook High-Income Earners in California January 21, 2025 Kami Molin Why You Need a Tax Advisor in California...

Tax Strategy CPA

Business Advisor

Helping Business Owners

Save Thousands In Unnecessary Taxes