Tax Advisor vs Tax Preparer... What's The Difference?

Tax Advisory Can Unlock Savings for High Income Earners

The Key Differences Between Tax Preparation and Tax Advisory

Every year around tax season, many individuals and business owners find themselves scrambling to collect documents in order to compile a list for their Tax Preparer. At our firm, we understand that this last minute approach to tax preparation often leaves little time for strategic tax planning & finding opportunities for savings.

As Tax Advisors, we help our clients throughout the year, making the tax preparation process a smooth checkpoint in our annual roadmap focused on tax savings strategies.

So, what’s the difference between a Tax Advisor and a Tax Preparer?

While both Tax Advisors and Tax Preparers work with clients on taxes, their expertise and services offered differ in important ways. As a Certified Public Accountant (CPA) firm with years of experience helping clients navigate their tax obligations, we’re here to break down the key differences between these two essential tax professionals.

If you’re concerned about paying more than you legally could be in taxes as a high-income earner, contact our office to get started with a consultation.

Our Capabilities

- Federal & State Tax Credits

- Income & Expense Shifting

- Business Entity Structures

- Tax Code Loopholes

- Tax Investment Strategies

- Financial Accounting Strategies

- New Tax Opportunities

How We Work

Our strategic tax planning service is tailored to proactively manage your tax position year-round. Comprehensive tax planning can help you reach your financial goals faster. We are experts with specialized training in tax-optimized strategies and tax advisory.

How Can Tax Advisory Help?

Tax preparers primarily focus on the compliance aspects of completing and filing tax returns. Tax Preparers can be CPAs, but their services will mostly focus around:

- Gathering and organizing your tax documents

- Inputting your data into tax preparation software

- Ensuring your tax information is accurate

- Completing & filing necessary tax forms

- Submitting those returns to the IRS and State

The key reason why we believe that high income earners require more than tax preparation is that most tax preparers work during tax season to meet compliance deadlines and basic tax regulations. If you work with a tax preparer, you can assume that they’re knowledgeable about tax codes and regulations, but their primary focus is on the present – accurately reporting your previous year’s financial activities. There’s little value a tax preparer can offer a top income earning tax payer that is filing for compliance a month or two before tax season.

Comparing a Tax Advisor vs a Tax Preparer

1. Consider a Tax Preparer if:

- Your tax situation is relatively straightforward

- You primarily need help with annual filing compliance

- You don’t anticipate major financial changes

- You’re comfortable missing out on tax planning

- Lowest cost is a primary concern

2. Consider a Tax Advisor if:

- You own a business or are self-employed

- You have complex investments or multiple income sources

- You’re planning major life changes (marriage, retirement, etc.)

- You need help with estate planning

- You want to proactively minimize your tax burden

- You’re interested in real estate investment

- You need ongoing financial guidance

The Strategic Role of a Tax Advisor

We believe that the Tax Advisor serves as a valuable strategic partner in your financial journey as a business owner, real estate investor, employer & taxpayer in a high tax rate state. Tax Advisors take a more comprehensive, forward-looking approach to tax planning & strategic implementation, unlocking the ability to create tax savings for many years.

We believe that the Tax Advisor serves as a valuable strategic partner in your financial journey as a business owner, real estate investor, employer & taxpayer in a high tax rate state. Tax Advisors take a more comprehensive, forward-looking approach to tax planning & strategic implementation, unlocking the ability to create tax savings for many years.

Tax Advisory work typically involves:

- Analyzing your tax & accounting situation

- Developing long-term tax optimization strategies

- Providing year-round tax planning advice

- Offering tax focused guidance on legal matters

- Helping with retirement planning & benefits plans

- Advising on tax implications of major life events

We’ve studied over 400 possible tax deductions in the U.S. tax code regulations. Our expertise is identifying & applying tax reductions other preparers may miss. You can rest assured your tax plan is based on well supported tax laws, keeping your business in the best tax position year-round. Working together on results focused tax strategies, we deliver tax advice and implementation that serves your overall financial picture.

Key Differences in The Level of Detail & Communication

Time Spent and Engagement Level

Tax Preparers typically interact with clients seasonally, primarily during tax filing season. Their focus is on completing accurate returns for the previous tax year.

Tax Advisors generally maintain ongoing relationships with clients throughout the year, helping them make informed decisions that impact their future tax situation.

Scope of Services Compared

While tax preparers excel at ensuring compliance and accurate filing, tax advisors provide comprehensive financial guidance related to business accounting & investment activity. As tax advisors and CPAs, our firm helps beyond just tax preparation by considering how various decisions – from investment choices to business structures – affect your overall tax position. This broader perspective as advisors allows us to identify opportunities for tax savings that might not be apparent during routine tax preparation.

Tax Planning & Strategic Implementation

One of the most significant differences between tax preparation and tax advisory involves tax planning & strategic implementation. The best tax advisors work proactively to help clients:- Structure business transactions tax-efficiently

- Plan for retirement and succession

- Optimize charitable giving strategies

- Minimize estate tax exposure

- Navigate complex tax situations like business sales or acquisitions

Why We Believe Tax Advisory is Critical

Our experience as Certified Public Accountants (CPAs) and Tax Advisors puts you in the position to benefit from tax planning & strategic implementation, while integrating your tax preparation needs into the on-going advisory process. At our firm, we view tax preparation as a ‘checkpoint’ in the tax advisory process. As your tax advisor, instead of only meeting once a year to file your income tax returns, we work together throughout the year so that at tax time, there are no surprises, and you pay as little income taxes as absolutely necessary.Working With Our Firm

After helping thousands of Californian taxpayers over the years, we have developed a powerful understanding of advanced tax strategies, making us particularly valuable for high-income earners. If you have been working with another Accountant, Enrolled Agent, Tax Preparer or Bookkeeper that doesn’t proactively bring savings to you, consider working with a dedicated Tax Advisor & Licensed CPA. We’re able to create a custom tax plan and implement a comprehensive tax-saving strategy aligned with your overall financial goals.Kami Molin, CPA is a Tax Advisor & Certified Public Accountant specializing in comprehensive tax planning and advisory services. With extensive experience in both individual and business taxation, she helps clients navigate complex tax situations while optimizing their financial outcomes.

7 Signs You’ve Outgrown Your Bookkeeper: A Tax Advisor & CPA’s Perspective

7 Signs You’ve Outgrown Your Bookkeeper: A Tax Advisor & CPA’s Perspective A CPA & Tax Advisor Can Offer Integrated Tax & Accounting Functions as a Partial CFO April...

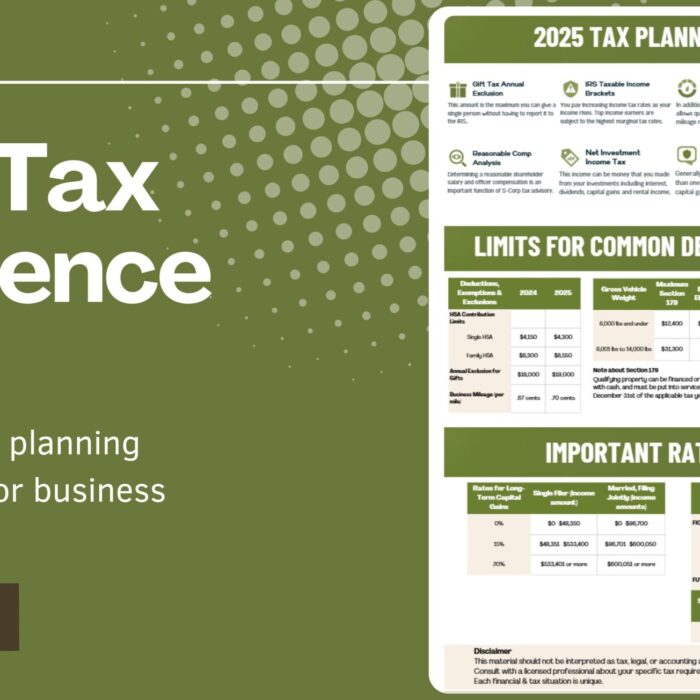

Essential 2025 Tax Reference Guide for Business Owners

Essential Tax Reference Guide for 2025 Our 2025 Tax Planning Reference Guide for High-Income Earners and Business Owners March 23, 2025 Kami Molin Check Out Our 2025 Tax Planning...

Tax Advisor vs Tax Preparer… What’s The Difference?

Tax Advisor vs Tax Preparer… What’s The Difference? Tax Advisory Can Unlock Savings for High Income Earners February 25, 2025 Kami Molin The Key Differences Between Tax Preparation and...

Tax Strategies for California High Income Earners in 2025

Tax Strategies for Californian High-Income Earners in 2025 This Year’s Tax Outlook High-Income Earners in California January 21, 2025 Kami Molin Why You Need a Tax Advisor in California...

Tax Strategy CPA

Business Advisor

Helping Business Owners

Save Thousands In Unnecessary Taxes